Litreca AG offers a range of experts that are optimally adapted to the needs of individual industries. All consultants have many years of cross-industry experience in the areas of treasury, payment transactions and financial accounting, so that practical implementation is guaranteed. In addition, Litreca AG relies on a mix of banking expertise, IT and process know-how.

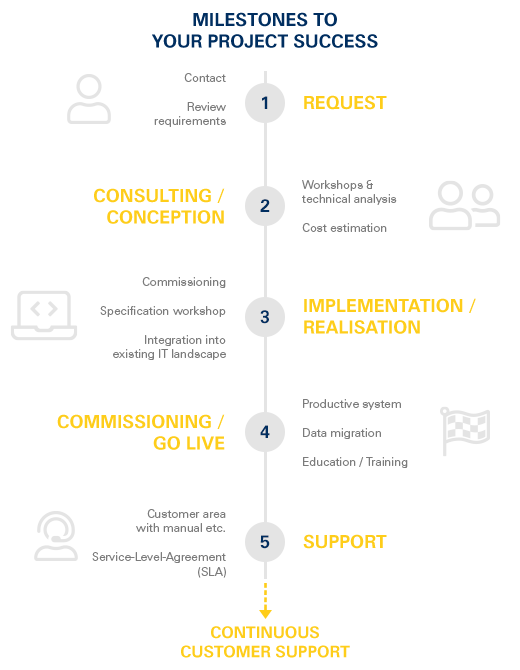

As a partner of our long-standing clients, Litreca offers excellent financial consulting – from process consulting in projects, holistic strategy development of payment processes to the implementation and continuous optimization of self-developed add-ons. With Litreca, companies rely on the expertise and experience of certified consultants.

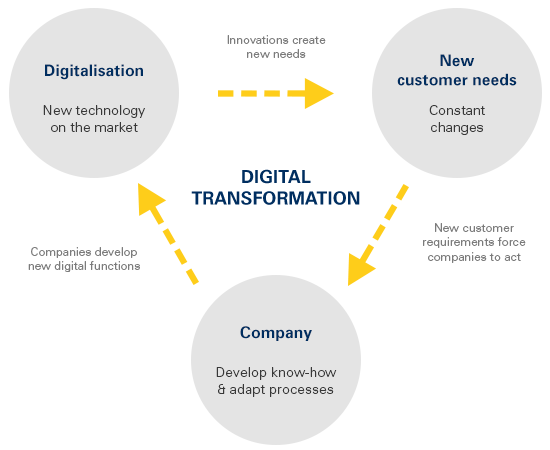

Digitalization and the growth of data are forcing companies to change their business models and restructure their IT in the financial sector. Litreca is tackling these challenges with the latest approaches, including S/4HANA and Fiori for faster processes, intuitive handling and greater flexibility. Our annually renewed Gold Partnerships in the SAP environment and Oracle attest to the continuous high competence and quality of the consulting.

Through the overarching technology knowledge of Litreca consultants, individual solutions are developed for companies, including hybrid solutions in the complex financial environment. Medium-sized and large companies often have a divergent system landscape, with a complex database – hybrid software solutions can create a common basis that intelligently connects SAP and other ERP systems. At Litreca, consultants and developers work hand in hand to provide holistic consulting that helps companies in all industries to advance both strategically and operationally.

A challenge that may mean a great deal of effort for companies, Litreca AG has already thought through and solved many times with its international customers. Analyzing processes, merging interfaces, relieving, securing and advancing in treasury are cornerstones of our daily work.

With intelligent solutions, midsize and large companies get more out of their data – with scalable and intelligent software solutions, sophisticated processes and solutions for reporting, analysing and planning. The real insight generates decision-relevant information.

Business processes behave dynamically – but sometimes, after prolonged use, exceptions become rules. Against the backdrop of growing data volumes, companies are often forced to rethink their financial management landscape. Usually a standardization is pending or the single-point-of-truth approach is to be implemented. An optimally positioned software architecture in finance not only offers performance and availability, but also takes complexity, flexibility and scalability into account for individual growth.

To ensure that everything runs smoothly, we support companies with excellent expertise – making it easier for them to adapt to new internal and external factors.

Shortage and retention of skilled workers

Increased networking due to globalization

Increased compliance requirements

New digital business models

Increasing complexity of processes

Location-independent activities

Increasing data volume

Increased sector specificity

Flexibility and speed for company success

Challenging and changing markets

Convince yourself personally of our strategic and professional know-how. Contact us without obligation and benefit from the expertise of our consultants.