A smart treasury management system must take into account the needs of daily use in terms of efficient and secure user guidance as well as the requirements of compliance management. It must be ensured that a complete and consistent picture of the financial and liquidity situation of the company or group and its development can always be drawn.

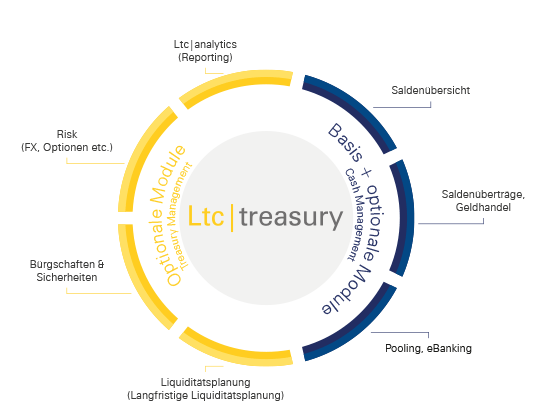

Ltc|treasury is an ERP-independent software that supplements the core functions of cash management with the following aspects: long-term corporate planning, corporate financing, asset management and risk management. With a smart treasury management program, companies optimize their financial and liquidity situation in a highly efficient way. In addition, you put your financial reporting on an audit-proof footing and receive standard and ad-hoc reports at the push of a button.

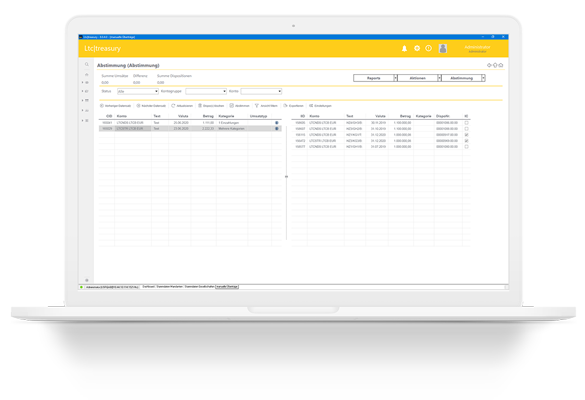

The finance department maintains the Treasury database centrally or decentrally using intuitive standard forms. Thanks to an integrated metadata management, individualization runs smoothly. Data that are subject to a high change rate or are managed in leading pre-systems are integrated into the database via interfaces. The Treasury Management Solution currency differentiates all positions and transactions that are necessary for the financial status and cash flow presentation.

Confidence in the work of the treasury department is built through a complete and consistent picture of a company’s financial and liquidity situation, as well as its further development. As an efficient management tool, the platform also supports the distribution of reports to defined stakeholders using time-controlled routines as part of workflow management.

Generate all relevant payments from all treasury modules in a fully integrated and automated way, monitor payment transactions from other applications as well and take them into account for your daily disposition. The system has functionalities for the permanent monitoring of transfer lists. You can also centralise the release processes and finally release payments in the Treasury and then automatically forward them to your e-banking platform or use the integrated e-banking module Ltc|bank to integrate all banks accessible via EBICS directly into the system.

Optimise the security of the process in particular and at the same time the convenience through the possibility of virtual company signatures or the release of payments in bulk.

In addition to the classic self-hosted on-premise software, Ltc|treasury can also be operated as a service in the cloud (SaaS). For this purpose, high-availability and high-performance data centres as well as a self-administering autonomous database are used. In order to meet all legal requirements regarding data security and compliance, including EU GDPR, these are located exclusively in Germany and are certified according to ISO/IEC27001.

- Multidimensional reporting environment, easy to use

- Daily financial status and cash flow at any time

- Currency-differentiated cash flow view

- Dailydisposition (short-term liquidity management, cash pooling etc. )

- Medium- and long-term liquidity planning (integration of open items, ordering, etc. )

- Documentation of loans and other financial commitments

- Manual or automatic interbank clearing

- Securities module manages stocks, funds and bonds

- An overview of collateral, mortgages and basic debts

- Managing risks in the interest rate and currency environment

- Report generator for reports and daily financial status

This is only a small excerpt of the functions included in Ltc|treasury. For the complete function overview, please feel free to contact us.

Then arrange a non-binding online presentation now, where you can take part from the comfort of your desk. Your personal contact person will present the system to you and competently answer your questions.

How long does it take to implement Ltc|treasury?

The time required for the conversion from an old system or from Excel to a professional TMS depends on the company’s specifics, ideally and when mapping common topics conversion is possible within 2 to 8 months, depending on the complexity.

What investments should be expected?

It is not possible to make a general statement here, as different factors play a role in licensing. As part of a specification, we analyse the current current situation and discuss your requirements and objectives together with you. Based on this, you will receive an offer tailored to your needs.

Do I have the possibility to import rates (FX or reference rates) into Ltc|treasury?

Yes, rates can be read in via the Bundesbank, ECB or other providers.

Can I connect trading platforms to Ltc|treasury?

Yes, to reduce manual activities, it is possible to connect trading platforms.

Is the Payment module independent of banks?

Yes, bank independence is at the core of Litreca’s payment transactions. The focus is on security and “straight through processing”. Companies decide independently how processing is to be carried out and benefit from clear processes.

We will be happy to answer your further questions about Ltc|treasury in person.