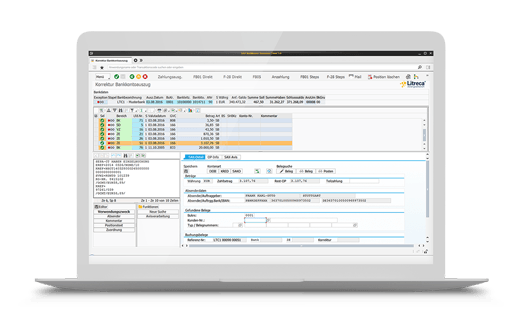

Finance and accounting can optimize its processes in the area of automatic bank statement processing. The use of a software solution for SAP makes the processing of the bank statements much more efficient and the specialist department is able to react flexibly and at short notice to any changes in the processing of incoming payments. A high level of acceptance is achieved by the complete integration into SAP, whereby the user interface is simple and clear to use.

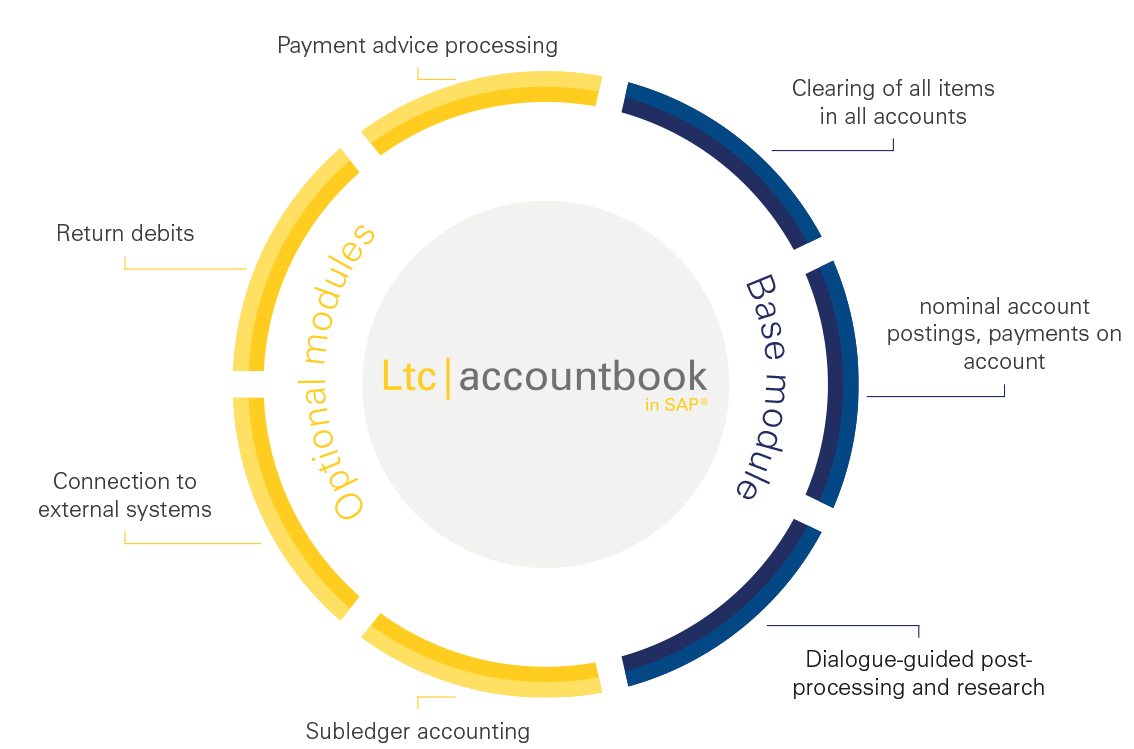

Ltc|accountbook in SAP® is a supplementary software that automates the accounting of statement with all transactions. The solution within SAP is characterized in particular by a high hit rate and simple manual post-processing. This gives companies an up-to-date liquidity overview for accounts receivable, accounts payable and general ledger account postings. Routine activities are reduced to a minimum and the scope for high-quality financial tasks are increased.

The bank supplies all account transactions in electronic format. The system reads, if desired job-controlled, the payment file completely, compares it and posts everything independently with the appropriate allocation. An excellent result is assured during the basis installation. A lot of SAP-centric information can be used for the assignment. All the settings in the system can be made by the relevant department itself, using the authorization roles assigned in SAP.

Refunds due to good will or other reasons require an up-to-date database. With Ltc|accountbook in SAP® it is possible to automatically fill the customer master records or the business partner master records (S4/HANA solution) with IBAN data.

Ltc|accountbook in SAP® is used across industries and is also available in English and French.

Special sector-specific requirements such as those in the utilities, waste disposal sector and in the health care sector can be taken into account.

Energy utilities

For energy suppliers, the system divides the individual payment transactions according to SAP® Core or IS-U relevance. Subsequently, financial transactions in the accounting areas (Core or IS-U) undergo extensive online audits.

Healthcare

In healthcare, it is possible to automatically process §301 SAMU records as well as to log copayments and dissolution of payment remarks in SAP FI or IS-H. In addition, transactions are supported at SAP IS-H, also from post-processing /correction run such as NE11 for additional payments and NE20 for advance payments.

- Clear open items of all types of accounts

- Processing of payment on accounts

- Dialogue-based post-processing

- Research electronic bank statements

- Compensation statistics

- Processing of payment advices

- Cross company code transactions

- 100% SAP integration

- In-memory database SAP HANA capable

- Test installation on request

This is only a small excerpt of the functions included in Ltc|accountbook in SAP®. For a complete overview of the functions, please feel free to contact us.

We will show you how you can optimally use Ltc|accountbook in SAP®, partly configure it yourself and thus use it sustainably. You decide whether you want to take a training course on site, on the web or with us at our branch in modernly equipped training rooms.

Kurs-Nr.: 111 - Ltc|accountbook in SAP

Description

After attending this course, you will be able to operate the Ltc|accountbook program in SAP® optimally. You will learn to configure the program and adapt it to your company-specific needs. You will easily set up new bank accounts and create search patterns, perform automatic G/L account postings, process payments on account and search electronic bank statements, process electronic and paper payment advices and set up cross-company code transactions.

Course content

Basic knowledge

- Theoretical basics

- Basic functions of the program and possibilities of settings

Operating interfaces

- Type and structure of application masks

- Configuration options of layouts

Tables

- Banks / Account assignment / Additional account assignment / Distribution of booking / Account determination / …

Setup bank accounts

- Required information / optional information / …

Creation of search patterns

- Necessary data / optional data / optimization / …

Automatic G/L account postings

- Posting logic: BUK / BANK / TAC / BA / BS / …

Process payment on accounts

- Direct booking during the read-in process/data import / post-processing: Deposit against debtor / Selection of open items of different debtors / Forwarding with mail function or comment / …

Research

- Possibilities within the electronic bank statements

Process Payment advice notes

- Electronic payment advice notes / paper payment advice notes

How can you benefit from Ltc|accountbook in SAP®?

We explain it to you!

How long does it take to implement Ltc|accountbook in SAP?

The time required to switch from manual to automatic processing of bank statements depends on the company’s own Specifics; in an ideal case and when mapping common themes, an implementation within 2 weeks to 3 months is possible, depending on complexity.

Can Ltc|accountbook in SAP process payment advices?

Yes, electronic payment advices can be processed.

Can the solution be used on multiple SAP systems at the same time?

No, the solution is set up for each SAP system individually. However, these can then exchange data via interfaces.

Can you also respond to individual requirements?

Ltc|accountbook in SAP is a ready-made solution and is used in several thousand company codes of our customers. Of course, our solution can also be modified accordingly to industry-specific customer requirements.

We will be happy to answer your further questions about Ltc|accountbook in SAP® personally.

Then arrange a non-binding online presentation now, where you can take part from the comfort of your desk. Your personal contact person will present the system to you and competently answer your questions.